Low Risk Industries List

Are you tired of playing it safe and looking for exciting opportunities in low-risk industries? Look no further, because we’ve curated a comprehensive list just for you! In this blog post, we’ll unveil the hottest sectors that offer stability, profitability, and longevity.

Whether you’re a budding entrepreneur or a seasoned investor seeking new avenues to diversify your portfolio, our low risk industries list is here to guide you towards success. Get ready to explore untapped potential and discover hidden gems in today’s market landscape – let’s dive right in!

Low-risk industries cater to a variety of needs, from essential domestic services to innovative technologies. We will discuss the benefits of each sector in detail, and review the current investment climate.

From basic energy storage solutions to cutting-edge medical technologies, there are opportunities for everyone. Government regulations, consumer trends, and economic forces can all influence which businesses will thrive in the future – so stay informed and be open to new possibilities!

Table of Contents

Introduction to Low Risk Industries

There are a number of different low risk industries that are available for investment. These include industries such as utilities, healthcare, and consumer staples. Each of these industries has its own unique set of characteristics which make it a low risk investment.

- Utilities: Utilities are typically considered to be low risk investments due to their stable earnings and cash flows. This stability is due to the fact that utilities are essential services that people need in order to live their everyday lives.

- Healthcare: Healthcare is another industry that is typically considered to be low risk. This is because the demand for healthcare services is always going to be high, no matter what the economic conditions are like.

- Consumer Staples: Consumer staples are also generally considered to be low-risk investments. This is because people will always need to purchase food and other essential items, no matter what the economic conditions are like.

These are just some of the low risk industries that are available for investment. Each industry has its own unique set of characteristics, so it is important to do your research before investing in any particular industry.

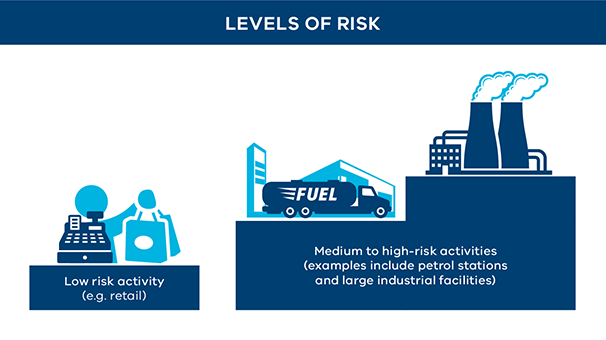

Categories of Low Risk Industries

There are many different types of low risk industries, and the list of low risk industries is constantly changing. Here are some of the most common categories of low risk industries:

Manufacturing

Construction

Transportation

Environmental Services

Healthcare

Education

Information Technology

Financial Services

Aerospace and Defense

Telecommunications

Consumer Goods and Services

Agriculture

Retail

Real Estate

Hospitality

Biotechnology

Energy and Utilities

Media and Entertainment

Chemicals and Pharmaceuticals

Examples of Low Risk Industries

There are many different types of businesses and industries that can be classified as low risk. The following are just a few examples:

- Food and beverage production

- Clothing and textile manufacturing

- Furniture manufacturing

- Toy manufacturing

- Cosmetic manufacturing

- Soap and cleaning product manufacturing

- Software and IT services

- Accounting and bookkeeping services

- Real estate investing and management

- Healthcare and medical services

- Financial consulting

- Transportation and logistics services

- Leisure, hospitality, and tourism services

Benefits of Investing in Low Risk Industries

There are a number of benefits to investing in low risk industries:

- Firstly, low risk industries tend to be more stable and predictable than high risk industries. This means that there is less chance of your investment losing value over time.

- Secondly, low risk industries tend to offer higher returns than high risk industries. This is because investors are willing to accept lower returns in exchange for the stability and predictability that low risk industries offer.

- Low risk industries can provide diversification benefits to your portfolio. By investing in a mix of high and low risk industries, you can reduce the overall risk of your portfolio.

- Finally, low risk industries tend to be less volatile than high risk industries. This means that the value of your investment will remain more consistent over time, which can provide peace of mind for long-term investors.

These benefits make investing in low risk industries a great option for conservative investors who are looking to protect and grow their investments over the long-term.

Challenges of Investing in Low Risk Industries

- There are a number of challenges that come with investing in low risk industries. One of the biggest challenges is finding companies that operate in these industries that also have solid financials and a track record of success. Low risk industries tend to be relatively mature, which means that there are often fewer opportunities for growth. This can make it difficult to find companies in these industries that offer investors a good potential return on their investment.

- Another challenge is that even though low risk industries tend to be more stable, they can still be affected by economic downturns. This means that investors need to be aware of the risks involved and be prepared to weather any potential bumps in the road.

- It’s important to remember that no investment is completely without risk. Even though low risk industries may offer a higher degree of safety, there is always the possibility of things going wrong. This is why it’s important to diversify your portfolio and not put all your eggs in one basket. By investing in a variety of different industries, you can minimize your overall risk and protect yourself from any potential setbacks.

- Finally, it’s important to remember that investing in low risk industries may not always offer the highest potential returns. These industries tend to be more conservative, so investors may have to accept lower returns in exchange for the greater level of security they offer.

Strategies for Investing in Low Risk Industries

There are a number of reasons why you might want to invest in low risk industries. Low risk industries tend to be less volatile and therefore offer investors a greater degree of stability and predictability. They also tend to have lower levels of debt, which can provide a buffer against economic downturns.

That said, there are a few things to keep in mind when investing in low risk industries. First, it’s important to diversify your portfolio across a number of different industries to mitigate risk. Second, don’t put all your eggs in one basket – even low risk industries can experience setbacks. Remember that no investment is ever completely free of risk – but by carefully choosing your investments, you can minimize your exposure to potential losses.

Here are some strategies to consider when investing in low risk industries:

- Research and Invest in Industries with Strong Fundamentals: When choosing which industries to invest in, it’s important to do your homework and research the fundamentals of the industry. Look at the company’s balance sheet, financial statements, management team, competitive landscape, and other factors that can give you an indication of whether or not the company is positioned for success.

- Focus on Companies with Good Cash Flow: Cash flow is a key indicator of a company’s financial health. Companies that have strong cash flow are better able to pay their bills and stay afloat during economic downturns. Investing in companies that have good cash flow can help you minimize your exposure to potential losses.

- Consider Long-Term Investments: Low risk industries tend to be slower-moving than more volatile ones, so investing with a long-term focus can help you benefit from compounding returns over time. Investing in well-established companies with solid fundamentals can provide you with both stability and growth over the long term.

- Diversify Your Portfolio Across Different Industries: Diversifying across different low risk industries can help you mitigate risk and maximize returns. Consider investing in a mix of defensive industries such as utilities, consumer staples, and healthcare as well as more cyclical sectors like financials, industrials, and technology.

- Invest in ETFs: Exchange-traded funds (ETFs) are a great way to invest in low risk industries while diversifying your portfolio across multiple assets. ETFs offer the added benefit of being highly liquid, allowing you to quickly move in and out of positions depending on market conditions.

By following these strategies, you can minimize your exposure to potential losses and maximize your returns over the long term. Investing in low risk industries can be a great way to protect your portfolio from volatility while still achieving growth.

Conclusion

We hope this list of low-risk industries has given you an idea of the types of businesses that are most likely to be successful in today’s market. While some industries may have more potential for growth than others, a well thought out business plan and strong management can often help even fledgling entrepreneurs succeed. It is important to research any industry before investing your time and money into it, but if done correctly, these low risk industries could provide you with a rewarding experience and steady income.

Additionally, many of the same principles that make these industries low-risk can also be applied to other types of businesses. This includes good financial decision making, sound management practices, and a strong focus on customer satisfaction. By following these guidelines, you can increase your chances of success no matter which type of business you decide to pursue. Finally, remember that even though some industries may have lower risks than others, there is always a risk associated with any kind of venture so it is important to plan carefully and take all necessary precautions.